Orlando has long attracted real estate investors thanks to tourism, major attractions, and steady year-round travel demand that supports short-term rentals. Even with these advantages, results vary widely. Some investors build profitable portfolios, while others struggle to break even or exit early.

The difference rarely comes down to luck. In 2026, successful Orlando Airbnb investors treat short-term rentals like a data-driven business, relying on research, systems, and realistic expectations instead of hype. Understanding how the Orlando vacation rental market 2026 is evolving and how top investors operate helps new buyers make smarter decisions before purchasing.

1. Orlando Remains One of the Top STR Markets

Orlando continues to rank among the most visited destinations in the United States. Theme parks, conventions, youth sports, and international tourism drive steady travel. This demand supports the city’s strong Airbnb investment Orlando Florida appeal.

However, a strong market does not guarantee strong returns. As more investors enter the space, competition increases. Guests have more choices and higher expectations.

Successful investors understand that demand alone does not create profit. Strategy does.

2. They Choose Location Based on Zoning, Not Emotion

New investors often fall in love with a home first and check rules later. Successful investors do the opposite.

They research short-term rental zoning Orlando regulations and HOA rules before making offers. Some communities restrict short-term rentals, limit frequency, or enforce strict guest policies.

Buying in an STR-friendly zone protects long-term viability. One zoning mistake can eliminate projected returns.

Top investors always confirm:

- City and county STR rules

- HOA policies

- Permit requirements

- Occupancy limits

3. They Study Real Performance Data

Successful Orlando Airbnb investors rely on real numbers, not estimates from social media or listing platforms. They verify data using reliable analytics tools and local market reports instead of trusting screenshots or income claims. This approach helps them separate realistic opportunities from hype-driven deals.

They analyze:

- Historical occupancy

- Average daily rate (ADR)

- Seasonal demand trends

- Comparable listing performance

4. They Focus on Cash Flow, Not Just Appreciation

Many new investors enter the market hoping rising property values will carry the deal. While appreciation can build long-term wealth, it does not pay monthly bills or cover operating costs. Successful investors understand that short-term rentals perform best when they work as income-producing assets from day one, not just as speculative plays.

That’s why experienced owners pay close attention to Airbnb cash flow Orlando potential before closing on a property. They want clear visibility into how much money comes in, how much goes out, and what remains at the end of each month. This focus on numbers reduces investment risk and supports smarter scaling.

They calculate:

- Mortgage and taxes

- Utilities and maintenance

- Cleaning and management

- Furnishing refresh cycles

- Platform fees

Running these numbers in advance reveals the true cost of operating an STR. It also highlights how small expenses, when combined, can significantly affect profit margins. Investors who skip this step often feel surprised by how quickly costs add up.

5. They Buy Properties That Fit Guest Demand

Guest demand drives revenue in short-term rentals, and strong-performing homes reflect what travelers actively want in a family-focused destination. In the Disney-area market, space and entertainment matter most, so successful owners design around guest preferences, not personal taste, which supports a smarter Orlando Airbnb investment strategy.

Popular features include:

- 4–6 bedroom layouts for families

- Themed kids’ rooms

- Game rooms or theaters

- Private pools

- Resort-style amenities

Successful investors focus on what guests actually book, because demand-backed features lead to better reviews, higher occupancy, and steadier returns.

6. They Treat STRs Like Hospitality Businesses

Top Orlando short term rental investors think like hoteliers because guest experience directly affects revenue. Cleanliness, clear communication, and smooth check-ins shape reviews and rankings, so serious operators treat hospitality as a core part of their Orlando Airbnb investment strategy.

They invest in:

- Professional photography

- Clear listing descriptions

- Fast guest messaging

- Reliable cleaning teams

- Maintenance systems

7. They Use Dynamic Pricing

Static pricing often leaves money on the table in a fast-moving STR market. Successful investors adjust rates based on real-time demand instead of using one flat price, which helps strengthen an Orlando Airbnb investment strategy.

Dynamic pricing considers:

- Seasonality

- Local events

- Competitor pricing

- Booking pace

- Holidays

This flexible approach supports stronger occupancy, better revenue, and more consistent performance.

8. They Understand the Orlando Vacation Rental Market 2026

The Orlando vacation rental market 2026 is more competitive than before, with growing supply and more selective guests. Successful investors stay proactive and adjust their Orlando Airbnb investment strategy to keep listings attractive and relevant.

Successful investors adapt by:

- Refreshing décor

- Updating photos

- Monitoring performance

- Improving amenities

They treat short-term rentals as evolving businesses, because ongoing updates help maintain strong demand and steady bookings.

9. They Build a Long-Term Strategy

Short-term rentals reward patience, and experienced owners plan beyond the first year. Instead of chasing quick wins, they build a steady Orlando Airbnb investment strategy that can handle market shifts and seasonality.

They consider:

- Market cycles

- Regulatory changes

- Reinvestment needs

- Brand building

- Repeat guest potential

A long-term view helps investors stay calm during slow seasons and make smarter, more stable decisions.

10. They Know When to Use STR Property Management Orlando

Self-managing works for some owners, but many find professional help improves consistency and performance. STR property management Orlando services help investors run smoother operations while strengthening their Orlando Airbnb investment strategy.

STR property management Orlando services support:

- Pricing optimization

- Guest communication

- Cleaning coordination

- Maintenance oversight

- Review management

11. They Avoid Emotional Buying

Emotional purchases often lead to regret in the STR space. Successful investors treat properties like business assets and rely on data to guide decisions as part of a smart Orlando Airbnb investment strategy.

They ask:

- Does the data support this purchase?

- Does zoning allow STR use?

- Does the layout fit demand?

- Do numbers work conservatively?

This disciplined approach protects returns and reduces costly mistakes.

12. They Learn from Market Leaders

Top investors study high-performing listings because success leaves clues. They analyze what top properties do well, from design choices to guest experience, and apply those lessons to strengthen their own Orlando Airbnb investment strategy. This research helps them spot patterns that drive bookings and reviews.

They observe design trends, amenity packages, and pricing patterns across leading listings. They also track how top performers present photos, write descriptions, and respond to guest needs. Learning from proven performers reduces guesswork and helps investors avoid costly trial-and-error losses.

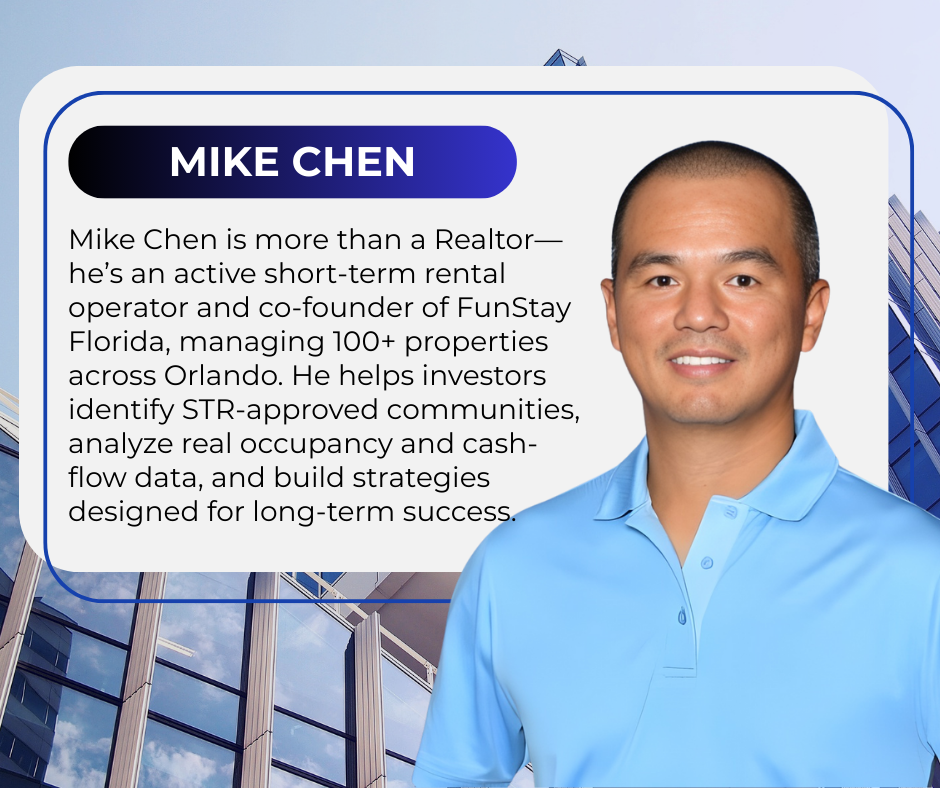

How Mike Chen Helps Orlando Airbnb Investors Win in 2026

Most Orlando Airbnb investors struggle because they buy based on hype instead of performance data. Mike Chen takes a different approach.

As a leading short-term rental Realtor in Orlando, co-founder of FunStay Florida, and an active owner managing 100+ properties, Mike brings real operating experience. He understands both acquisition and execution.

He helps investors:

- Identify STR-approved communities

- Analyze occupancy, ADR, and cash flow

- Avoid zoning and HOA issues

- Compare mid-size vs large-home performance

- Plan furnishing and positioning strategy

- Transition smoothly into management

Orlando STR success is not about buying the biggest house. It is about buying the right one in the right zone with the right strategy.

If you want to invest like successful Orlando Airbnb investors in 2026, speak with someone active in the business daily.

Invest Smarter in Orlando STRs Before You Buy

Successful Airbnb investment in Orlando Florida depends on preparation, data, and the right strategy. Investors who treat short-term rentals like real businesses often outperform those chasing quick wins. Smart location selection, realistic projections, and strong operations separate profitable properties from disappointing ones.

The Orlando market still offers strong opportunities, but buying the wrong home in the wrong zone can limit returns from day one. If you want to invest like successful Orlando Airbnb investors in 2026, work with someone who understands both the numbers and the day-to-day reality of running STRs.

Mike Chen works directly with investors to identify STR-approved communities, analyze real performance data, and build long-term strategies that hold up beyond year one. Speaking with an STR-focused expert before you buy can help you avoid costly mistakes and choose a property built for sustainable success.

EN

EN

ZH

ZH